Do You Know Your Credit Score?

What is a Credit Score?

A credit score is a three-digit number generated from an analysis of information in a consumer’s credit bureau file. The score

summarizes your credit risk, based on your credit data. Credit score offers a snapshot of how you're managing your credit. It is a tool used by lenders to predict how likely an individual is to repay a new loan.

Creditors use your credit score to help determine whether to give you credit. It also may be used to help decide the terms you are offered or the rate you will pay for the loan.

When you apply for a car loan or mortgage, your lender will request a credit report from one or all of the three major Credit Bureau. TransUnion, Experian and Equifax pulls together a credit report electronically. The credit report is then provided to a subscribers, such as landlords, mortgage lenders, credit card companies and others who are deciding whether or not to extend you credit.

Along with the credit report information, the three major Credit Bureau also provides a three digit numerical score called a credit score. The Credit Score represents a composite of the borrower's credit history, employment, ability to save, and so on. Lenders use credit scores to help them determine if you are a risky borrower and which terms (rates and conditions) they may offer you. The most popular of these scores is known as the FICO score, which was a model developed by the Fair Isaac Corporation a number of years ago.

FICO Score

FICO® Score is a three-digit number calculated from the data on your credit reports at the three major consumer reporting agencies - Equifax, Experian, and TransUnion.

What does your FICO Credit Score mean?

Lenders use credit scores because they provide information on how customers performed on loan payments and helps predict how likely an individual is to repay a new loan. In order words your FICO Score is meant to develop a snapshot of the risk you currently represent to a lender. Several parameters in your credit file, including payment history, amounts owed, length of credit history, number of open accounts, type of credit used, public records, and others are formulated to produce a three-digit score between about 350 and 850. The higher the number, the better

Note:

A credit score only represents the probability of repayment and does not guarantee a loan will be repaid according to the terms.

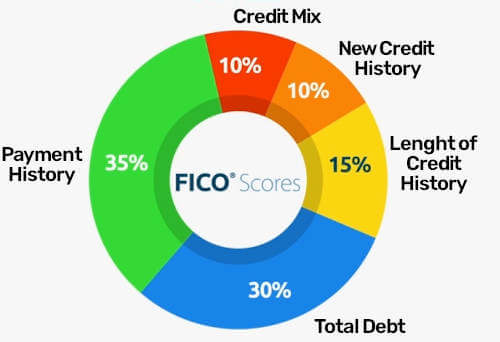

5 Factors that make up your FICO credit score

Payment History (35% of your scores) This is the most important factor in calculating credit scores. Looks at items such as:

Payment History (35% of your scores) This is the most important factor in calculating credit scores. Looks at items such as:Whether you've paid past credit accounts on time.

Whether you've missed payments and if so, how often. How recently and how late were they?

Have you had debts turned over to a collection agency.

Do you have foreclosures or have you filled for bankruptcy.

Note: The more recent, the more frequent and the more severe the negative items are, the bigger the impact it will have on your FICO® Score.

Having a long history of making payments on time on all types of credit accounts is an indication of future behavior and it's one of the most important items lenders look for.

Credit Utilization (30% of your scores) This is the second most important factor and calculates the percentage of your available credit that has been borrowed. Credit utilization considers your debt and your available credit lines.

Credit Utilization (30% of your scores) This is the second most important factor and calculates the percentage of your available credit that has been borrowed. Credit utilization considers your debt and your available credit lines.

It looks at the amount of credit and loans you are using and seeks to answer the following:

-

Are your credit cards nearly maxed-out,

How many accounts with balances do you have?,

How much of your available credit is being used.

If you are overextended, you're more likely to miss future payments.

The bottom-line, the more you owe compared to your credit limit, the lower your score will be. The key here is to try to maintain low credit card balances. Do not max out credit cards or get close to your credit limit.

Length of credit history (15% of your scores) Checks how long you had your credit accounts and how often you use them. A longer credit history provides more information and offers a better picture of long-term financial behavior, thereby increasing your FICO score. Generally a credit report containing accounts opened for at least 10 years or more will help your credit score.

Length of credit history (15% of your scores) Checks how long you had your credit accounts and how often you use them. A longer credit history provides more information and offers a better picture of long-term financial behavior, thereby increasing your FICO score. Generally a credit report containing accounts opened for at least 10 years or more will help your credit score.

Here's an example of how your Length of credit history is evaluated

How long you've had credit - From your oldest to newest account

Student loan - opened 5 years ago

Car loan - opened 4 years ago

Credit Card - opened 3 months ago

Age of Oldest Credit - 5 years

Age of Newest Credit - 3 months

Average Age of Credit - 3 years

New credit (10% of your scores) Looks at:

New credit (10% of your scores) Looks at:Frequency of credit inquires and new account openings

New credit applications

How often have you actively applied for credit in the last 12 months

Multiple credit requests represent greater credit risk and is viewed as an indication you are in financial trouble.

The following Soft inquiries do not count against you:

Rate shopping, Promotional, Consumer Disclosure, Insurance or Employment inquiries don't count against you.

Credit Mix (10% of your scores) Considers the mix of your credit accounts, retail accounts, installment loans, finance company accounts and mortgage loans you have. Borrowers with a diverse credit portfolio of revolving credit and installment loans generally represent less risk for lenders and thereby score well.

Credit Mix (10% of your scores) Considers the mix of your credit accounts, retail accounts, installment loans, finance company accounts and mortgage loans you have. Borrowers with a diverse credit portfolio of revolving credit and installment loans generally represent less risk for lenders and thereby score well.

It's important to mention that lenders usually use a combination of your credit score with other factors when determining your risk. While there is no single number universally used by financial institutions, data on late payments indicates that people with FICO scores below 669 have a significantly higher rate of making late payments. For that reason lenders tend to charge people with scores lower then 669, higher interest rates and fees on their loans. How much more?, take a look at the cost of bad credit.

Why is a Credit Score Important?

Your credit score is important because most lenders make lending decisions and the interest rate you will be charged, based in part on your credit score. Generally, the higher your score, the lower the interest rate you're going to pay.

Other factors that determine you credit-worthiness

It's worth mentioning that the lender, not a credit score, makes the final decision to approve or reject a loan or credit card application. A credit score is simply a tool used by the lender. The lender may take into consideration any special reasons for your past credit problems.

In addition to your credit score, lenders look at many things when making a credit decision, including your income, if you have an equity investment in a home, job history, savings, and the kind of credit for which you are applying before making a final decision.

BXImpact Credit Video

Prime and Sub-Prime or Worse

All lenders have the same objective, to determine the borrower's potential risk. Regardless of whether the score was generated by FICO or a system based on FICO parameters, they all yield an industry standard three-digit score. This score places the borrower in one of three main categories.

Prime - If your credit score is above 680, you are considered a "prime borrower" and will have no problem getting a good interest rate on your home loan, car loan, or credit card.

Sub-Prime - If your credit score is below 680, you are considered a "sub prime borrower", and will likely pay a higher interest rate on your loan.

Worse - If your credit score is below 560, you can still get a credit card but you will likely be hit with a security deposit or high acquisition fee. In addition to that your interest rate will likely be 22 to 23%. You can forget about most home loans and the majority of new car loans at this score.

Below 579 is no place to be. You will pay much, much more in higher interest and unnecessary fees. You may even pay more for your insurance rates. A very low score can even prevent you from getting a job with many companies.

Breakdown of your Risk Level

FICO® Scores generally range from 300 to 850, with higher scores demonstrating lower credit risk and lower scores demonstrating higher credit risk.

FICO Scores in the 800 to 850 range are considered exceptional. Lenders rest easier when they extend loans and credit to individuals with high Credit Scores. Plus, you may be able to save money by negotiating a lower interest rate or a better term on a new loan or credit card.

FICO Scores in the 740 to 799 range are deemed very good. Lenders may be more willing to extend credit to individuals with Credit Scores in the low-to-medium risk range. In this range, you may get better-than-average rates and terms on new loans and credit cards.

FICO Scores in the range of 670 to 739 are rated good. Lenders view consumers with scores in this range as "acceptable" borrowers and may still be willing to extend loans and credit to individuals with mid-range Credit Scores; however, you may only get average rates and terms.

FICO Scores that range from 580 to 669 are considered fair. Lenders may be less willing to extend credit to individuals with Credit Scores in this range if they apply for mainstream loans. Consumers in the 580 to 669 range may be considered subprime borrowers, eligible only for loans with interest rates significantly higher than the best rates available.

FICO Scores that range from 300 to 579 are categorized as poor. Lenders may be reluctant about extending loans and credit to individuals with Credit Scores in the high-risk range. You may be denied credit, required to put down sizable security deposits or pay higher rates.

What is a good FICO® Score?

FICO Scores range from 300 to 850, with higher scores demonstrating lower credit risk and lower scores demonstrating higher credit risk. What’s considered a "good" FICO Score varies. Each lender has its credit risk standards, as a result what's considered a "good" FICO Score varies by lender. For example, one lender may offer its lowest interest rates to people with FICO Scores above 730, another lender only to people with FICO Scores above 760.

How is your credit score calculated

There is no simple answer to this question. Each bureau has its own way of calculating your credit score. They simply adapt your FICO score to their specifications. For that reason, credit scores reported by the Credit Bureau are sometimes referred to as “Bureau Scores.”

One of the important things to know when you read the section, "How to Repair Bad Credit" is that because your score is derived from your bureau data, it will change every time your reports changes. There is not a single factor that determines your credit score. There are many categories that are taken into consideration when your score is calculated.

Note: Whenever you apply for credit or a loan, by signing the application form, you are giving the creditor permission to order your credit report from a credit-reporting agency. Here are some other credit facts you might need to know.