What's on Your Credit Report

What is a credit report?

A credit report is a record of how you have paid your bills, where you live, and whether you've been sued or filed for bankruptcy. A credit report also shows any monthly debt you might have, your loan repayment history, for example, if you have made payments on time, or if you have not paid back some loans at all. You credit card balances and credit limit.

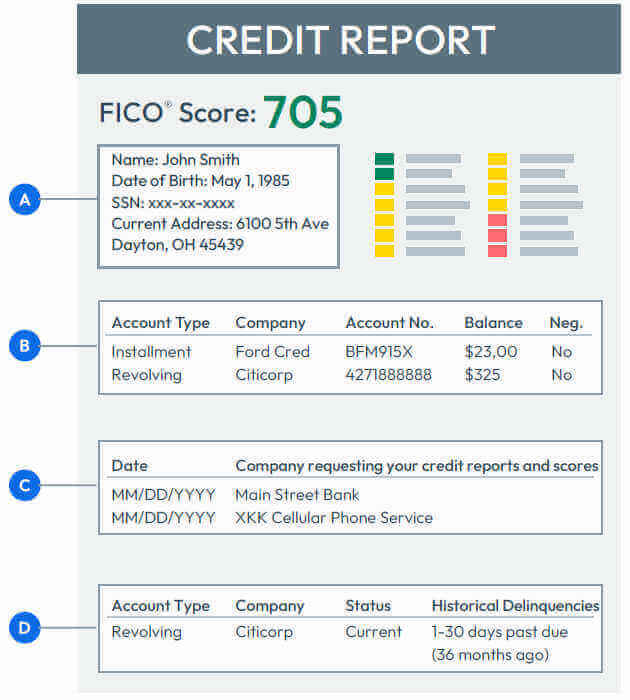

Credit reports are compiled by the 3 credit-reporting agencies. The typical credit report includes four sections of information:

What's in a Credit Report?

Although each consumer reporting agency formats and reports this information differently, all credit reports contain the same categories of information.

1 Identifying information: This section of the report contains information about yourself. Your full name along with other variations that have been used, current and previous addresses, phone number, Social Security number, date of birth, and current and previous employment information. The information in this section of your credit report is only used to identify you. Updates to this information come from your credit applications or when you report them directly to the credit bureaus.

2 Credit Accounts: Most lenders report information about each account you have established with them. Specific details about your credit cards, student loans, car loans and other loans. This information includes the type of credit account, the date you opened the account, your credit limit or loan amount, the account balance, and your payment history.

3 Payment information: Your monthly payments if any, on all accounts. This section of your credit report also shows your payment history during the past several years. Information in this section of your credit report comes from companies you do business with.

4 Public record information: This section contains information about you that are public record (on file at a court, or county records). Information like, bankruptcies, collections, foreclosures, tax liens for unpaid taxes, monetary court judgments (such as lawsuits), and, in some states, overdue child support. This information comes from public records.

5 Debts: Debts owed on all accounts including mortgages, credit cards, student loans and auto loans

6 Credit Inquiries: This section, contains a list of those who obtained a copy of your credit report and how often you have applied for credit in the past two years. You should know, when you apply for a loan, you authorize your lender to ask for a copy of your credit reports. This is how inquiries appear on your reports.

In this section of your credit report, you may also see the names of companies that have reviewed your report for "pre-approved" credit offers (Soft inquiries). You shouldn't worry about that because those names are not given to creditors who request a copy of your report. Creditors will only see the inquiries you initiate when you apply for a new credit (Hard inquiries).

7 Negative information: This section shows your late payments, skipped payments, settled accounts, charge offs, accounts turned over to a collection agency, repossessions and other derogatory items. Information in this section of your credit report comes from companies you do business with.

BXImpact Credit Video

Reviewing Your Credit Report

Most people never consider obtaining their credit reports until they are denied credit or attempting credit repair their credit. It is important to review your credit history at least once a year. Having a good understanding of your credit report and what's on it is very important. Take advantage of the fact that each of the three credit reporting agencies will provide you with a free copy of your credit report, at your request, once every 12 months.

Your Free Credit Report

You have the right to get a free copy of your credit file disclosure, commonly called a credit report, once every 12 months, from each of the nationwide consumer credit reporting companies, Equifax, Experian and TransUnion. Get a copy of your credit report. This is the best way to find out if you have good credit or not.

Request a Free Equifax Credit Report

Request a Free Equifax Credit Report by downloading the Credit Report form to submit by mail.

Minor Credit Report

Incapacitated Adult Credit Report

Keep in Mind:

Opening a new account, and the credit inquiry associated with applying for the new account, may demonstrate to the lenders a higher risk in the short term.